People often assume major artists rake in huge profits every time they hit the road. The reality is far less glamorous. Large-scale tours can drain budgets fast, especially once production costs, staff pay, and travel bills start stacking up. Even legendary performances like the one referenced through alison krauss robert plant black dog remind us that behind great shows sits a massive financial machine that can wobble under pressure.

Rising Production Costs That Outrun Ticket Sales

Modern tours place heavy emphasis on spectacle. Light shows, custom staging, pyrotechnics, and huge screens cost a fortune. While fans enjoy the experience, the bill grows like ivy on an old wall. If ticket sales don’t surge enough, artists feel the financial pinch fast. Transporting all that gear adds another layer of expense. Trucks, crew members, and constant travel burn through funds daily. Even small delays or equipment issues can increase spending. One bad week on the road can tip the balance from profitable to stressful.

Marketing Expenses That Don’t Always Pay Off

Big tours often rely on massive promotional campaigns. Ads, social strategies, and partnerships can cost as much as a small indie film budget. The hope is that hype boosts sales drastically. But sometimes the crowd response doesn’t match the investment. Marketing teams can misjudge audience interest. Trends shift quickly, and a tour built around an older album might not hit projected numbers. Money spent on promotion doesn’t automatically guarantee packed venues. Some artists end up paying more to promote the show than they earn from it.

Unpredictable Attendance and Shifting Fan Behavior

Ticket sales used to be a steadier stream. These days, buying patterns feel more like a roller coaster. Fans hesitate, budgets tighten, and last-minute decisions are common. This unpredictability creates financial pressure for artists planning months ahead. Even big artists face no-shows or half-filled venues. External events, economic dips, or even bad weather can dent turnout. Tours rely heavily on consistent attendance to stay profitable. When crowds don’t show up, the financial hit lands quickly.

Travel Complications That Drain Budgets

Moving a tour across different cities is never simple. Fuel prices change, travel restrictions shift, and lodging costs vary wildly. Each stop presents a new set of expenses. Even minor adjustments can throw off the budget. International tours bring added layers of cost. Visas, shipping fees, and currency differences stretch finances further. One unexpected cancellation can ripple through the entire schedule. The pressure to keep everything on track becomes intense.

Insurance, Staff, and Other Hidden Costs

Insurance is a major part of touring, especially for high-profile acts. Policies for equipment, cancellations, and liability come with steep premiums. These costs often surprise fans who assume revenue solves everything. Then comes staff pay. Crews include sound techs, lighting pros, drivers, coordinators, and many others. Each paycheck adds up quickly. Even food and lodging for the team can cost thousands over a long tour. What seems like a glamorous operation is, in truth, a giant financial puzzle that doesn’t always fit neatly.

Some tours earn huge profits, while others barely break even. The money behind the scenes is far more fragile than most people think. For big artists, touring is a mix of passion, risk, and a long list of expenses that demand constant attention. Understanding these financial pressures paints a clearer picture of why some tours become difficult investments despite their star power.…

Home damage often comes with unexpected expenses. Creating a detailed budget that encompasses both immediate and long-term needs is crucial. Identify areas where you can cut back on discretionary spending while prioritizing essential expenses. Communicate with utility providers and creditors to discuss possible payment extensions or alternative arrangements to ease financial strain.

Home damage often comes with unexpected expenses. Creating a detailed budget that encompasses both immediate and long-term needs is crucial. Identify areas where you can cut back on discretionary spending while prioritizing essential expenses. Communicate with utility providers and creditors to discuss possible payment extensions or alternative arrangements to ease financial strain.

Your employees cost a lot of money. If you’re located in the United States, specific rules dictate how much your employees must be paid for their time and effort. There is also overtime pay to consider, which means if an employee works more than 40 hours one week, they must receive extra compensation on top of what they would typically get paid for 40 regular hours. You can avoid all of these costs if you hire someone to do the job for you.

Your employees cost a lot of money. If you’re located in the United States, specific rules dictate how much your employees must be paid for their time and effort. There is also overtime pay to consider, which means if an employee works more than 40 hours one week, they must receive extra compensation on top of what they would typically get paid for 40 regular hours. You can avoid all of these costs if you hire someone to do the job for you. It’s not just labor that can add up quickly; operating expenses for your company are constantly increasing as well! You might have to pay rent on your office space, utilities like electricity and water bills each month, physical inventory costs if you run a business with some sort of goods/products being sold directly to customers, etc. You can reduce all of these expenses by outsourcing jobs that are not core to your company’s mission or don’t generate revenue for the organization.

It’s not just labor that can add up quickly; operating expenses for your company are constantly increasing as well! You might have to pay rent on your office space, utilities like electricity and water bills each month, physical inventory costs if you run a business with some sort of goods/products being sold directly to customers, etc. You can reduce all of these expenses by outsourcing jobs that are not core to your company’s mission or don’t generate revenue for the organization. Remember that outsourcing is not just about cutting costs! In many cases, businesses can actually save money in the long term by hiring a third party to handle certain functions.

Remember that outsourcing is not just about cutting costs! In many cases, businesses can actually save money in the long term by hiring a third party to handle certain functions.

If you have a job, then it’s likely that the minimum requirement to get approved for a payday loan is also around your monthly salary. You can usually receive cash within 24 hours or less of applying and being approved – so if you need emergency cash fast, this is an option worth considering. Many people even report getting the money in their account within an hour or two of applying and being accepted.

If you have a job, then it’s likely that the minimum requirement to get approved for a payday loan is also around your monthly salary. You can usually receive cash within 24 hours or less of applying and being approved – so if you need emergency cash fast, this is an option worth considering. Many people even report getting the money in their account within an hour or two of applying and being accepted. If you don’t pay back your payday loan on time, then the company will likely try to collect it from you any way they can. They might even contact other people in your life – like family members or friends who know where you live and work. This could make things very uncomfortable for many people, so keep this in mind if you’re thinking about taking out a payday loan.

If you don’t pay back your payday loan on time, then the company will likely try to collect it from you any way they can. They might even contact other people in your life – like family members or friends who know where you live and work. This could make things very uncomfortable for many people, so keep this in mind if you’re thinking about taking out a payday loan.

The investor relation consultancy will be like the pillar on which the investors will be communicated through if they have relevant issues. It has helped so much when it comes to the communicating to the investors, and they have improved the process too.

The investor relation consultancy will be like the pillar on which the investors will be communicated through if they have relevant issues. It has helped so much when it comes to the communicating to the investors, and they have improved the process too.

For the changes in the enterprise to be fully implemented, an individual who is a manager should be a good leader. The change must be organized and planned by the director, and his or her leadership skills should be put in practice so as he or she can inspire employees to embrace the changes. Leadership is an impalpable and complex skill that involves an individual passing information to a particular group of individuals and at the same time encouraging them to embrace a position.

For the changes in the enterprise to be fully implemented, an individual who is a manager should be a good leader. The change must be organized and planned by the director, and his or her leadership skills should be put in practice so as he or she can inspire employees to embrace the changes. Leadership is an impalpable and complex skill that involves an individual passing information to a particular group of individuals and at the same time encouraging them to embrace a position. When the right information is passed to the employees relating to the vision of the firm, the preset goals and objectives are likely to be attained under the specified duration of time. Communication is a vital factor of managing change easily with minimum problems experienced. Direct reports in the company must be run by managers so that operations in the business to run smoothly and delays will be avoided.…

When the right information is passed to the employees relating to the vision of the firm, the preset goals and objectives are likely to be attained under the specified duration of time. Communication is a vital factor of managing change easily with minimum problems experienced. Direct reports in the company must be run by managers so that operations in the business to run smoothly and delays will be avoided.…

A small business that cannot afford to purchase equipment can opt to lease equipment as a financing option. However, it is not the ideal financing option for a small business, but it offers a good way for a small business to get started. After all, there is an option of purchasing the equipment at the end of the lease. At the expiry of the lease, the business should be in a position to purchase the equipment.

A small business that cannot afford to purchase equipment can opt to lease equipment as a financing option. However, it is not the ideal financing option for a small business, but it offers a good way for a small business to get started. After all, there is an option of purchasing the equipment at the end of the lease. At the expiry of the lease, the business should be in a position to purchase the equipment.

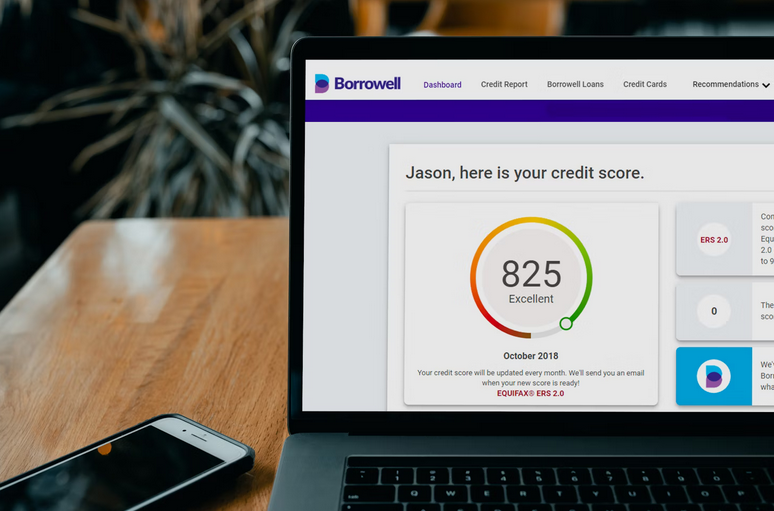

One of the most important financial tips is to use cash instead of credit. Many financial advisors suggest the use of cash instead of credit card due to the tendency to spend more when using credit cards. A person will tend to spend more when using a credit card than when using cash. Therefore, let the credit card come only during emergencies.

One of the most important financial tips is to use cash instead of credit. Many financial advisors suggest the use of cash instead of credit card due to the tendency to spend more when using credit cards. A person will tend to spend more when using a credit card than when using cash. Therefore, let the credit card come only during emergencies.