Achieving a high net worth is a significant financial milestone that comes with numerous benefits. For example, Iman Gadzhi net worth reflects financial stability and success and opens up various opportunities to enhance his quality of life and financial well-being. From investment options to lifestyle perks, having a high net worth offers several financial advantages that can pave the way for future growth and security.

Access to Exclusive Investment Opportunities

One of the primary financial advantages of having a high net worth is access to exclusive investment deals and chances. High-net-worth individuals (HNWIs) are often invited to participate in private equity deals, hedge funds, venture capital investments, and other high-yield opportunities not available to the general public. These investments usually have the potential for higher returns, helping to grow wealth more rapidly.

Preferential Treatment From Financial Institutions

High-net-worth individuals receive preferential treatment from financial institutions. Banks and financial advisors offer personalized services to attract and retain HNWIs as clients. They also provide dedicated wealth management services, including financial planning, tax optimization, and estate planning. This personalized attention ensures that HNWIs can effectively manage and grow their wealth while minimizing financial risks.

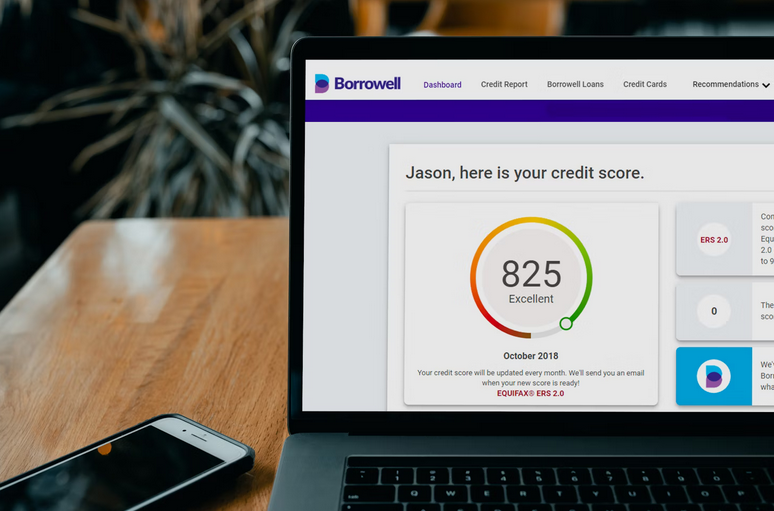

Enhanced Creditworthiness

Having a high net worth significantly enhances an individual’s creditworthiness. Lenders and creditors are more likely to give favorable terms to those with substantial assets. This improved credit profile makes it easier for HNWIs to secure financing for various purposes, including purchasing property, starting or expanding a business, or investing in other ventures. Enhanced creditworthiness also provides greater financial flexibility and the ability to make use of time-sensitive opportunities.

Tax Advantages and Planning

High-net-worth individuals can benefit from various tax advantages and sophisticated tax planning strategies. With the help of experienced tax advisors, they can leverage tax-efficient investments, utilize charitable giving strategies, and structure their income and assets in ways that minimize tax liabilities.

Increased Philanthropic Impact

Achieving a high net worth provides the financial capacity to make a significant philanthropic impact. HNWIs can support causes they are passionate about through substantial donations, endowments, and the establishment of charitable foundations. This not only helps to create positive social change but also offers potential tax benefits. Philanthropy allows HNWIs to leave a lasting legacy and make meaningful contributions to their communities and society.

Greater Financial Security and Peace of Mind

Having a high net worth offers a sense of financial security and peace of mind. It provides a protective net against economic downturns, unexpected expenses, and other financial challenges. This security allows HNWIs to take calculated risks, pursue new opportunities, and confidently make long-term plans.

Lifestyle Perks and Opportunities

A high net worth also brings various lifestyle perks and opportunities. HNWIs can afford luxury travel, premium accommodations, and exclusive experiences that enhance their quality of life. They have the financial freedom to pursue hobbies, interests, and passions without financial constraints.

In conclusion, achieving a high net worth offers numerous financial advantages beyond mere monetary value. By effectively managing and leveraging their wealth, high-net-worth individuals can ensure continued growth, security, and prosperity for themselves and their families.…

Without a clear plan, how can you expect to reach your desired financial goals? Having no financial plan is like driving blindfolded – it’s risky and likely to lead you off course. A solid financial plan is the GPS of your money journey. It helps you navigate through life’s twists and turns, ensuring that you stay on track towards your objectives. By setting specific goals, creating a budget, and outlining actionable steps, you can take control of your finances and steer them in the right direction. Without a roadmap for your money, it’s easy to fall into bad spending habits or miss out on opportunities for growth.

Without a clear plan, how can you expect to reach your desired financial goals? Having no financial plan is like driving blindfolded – it’s risky and likely to lead you off course. A solid financial plan is the GPS of your money journey. It helps you navigate through life’s twists and turns, ensuring that you stay on track towards your objectives. By setting specific goals, creating a budget, and outlining actionable steps, you can take control of your finances and steer them in the right direction. Without a roadmap for your money, it’s easy to fall into bad spending habits or miss out on opportunities for growth. Lastly, neglecting investments can be a major

Lastly, neglecting investments can be a major

Climate change poses a wide range of risks, from extreme weather events to rising sea levels and changes in disease patterns. These risks can have severe consequences for individuals, businesses, and entire communities. For the insurance industry, these risks translate into increased payouts as losses due to natural disasters and other climate-related events continue to rise. This has put immense pressure on insurers to reassess their risk assessments and find ways to adapt to the changing climate.

Climate change poses a wide range of risks, from extreme weather events to rising sea levels and changes in disease patterns. These risks can have severe consequences for individuals, businesses, and entire communities. For the insurance industry, these risks translate into increased payouts as losses due to natural disasters and other climate-related events continue to rise. This has put immense pressure on insurers to reassess their risk assessments and find ways to adapt to the changing climate. Climate change poses unprecedented challenges to the insurance industry, but it also presents an opportunity for innovative

Climate change poses unprecedented challenges to the insurance industry, but it also presents an opportunity for innovative

Home damage often comes with unexpected expenses. Creating a detailed budget that encompasses both immediate and long-term needs is crucial. Identify areas where you can cut back on discretionary spending while prioritizing essential expenses. Communicate with utility providers and creditors to discuss possible payment extensions or alternative arrangements to ease financial strain.

Home damage often comes with unexpected expenses. Creating a detailed budget that encompasses both immediate and long-term needs is crucial. Identify areas where you can cut back on discretionary spending while prioritizing essential expenses. Communicate with utility providers and creditors to discuss possible payment extensions or alternative arrangements to ease financial strain.

Another great way to make money quickly is by doing odd jobs for people in your area. This could involve anything from mowing lawns and shoveling snow to walking dogs and running errands. And the best part is that you can usually set your own hours and rates. So if you need some quick cash and don’t mind getting your hands dirty, this could be the perfect option for you.

Another great way to make money quickly is by doing odd jobs for people in your area. This could involve anything from mowing lawns and shoveling snow to walking dogs and running errands. And the best part is that you can usually set your own hours and rates. So if you need some quick cash and don’t mind getting your hands dirty, this could be the perfect option for you. Of course, one of the easiest ways to get money quickly is by borrowing it from a friend or family member. Just make sure you’re prepared to pay them back as soon as possible. And if you can’t repay them, be sure to at least offer some form of collateral so they know their money is safe. As you can see, there are plenty of ways to get money quickly and easily in an emergency. So if you find yourself in a bind, don’t hesitate to use one of the methods listed above. And who knows, you may even be able to make some extra cash in the process.

Of course, one of the easiest ways to get money quickly is by borrowing it from a friend or family member. Just make sure you’re prepared to pay them back as soon as possible. And if you can’t repay them, be sure to at least offer some form of collateral so they know their money is safe. As you can see, there are plenty of ways to get money quickly and easily in an emergency. So if you find yourself in a bind, don’t hesitate to use one of the methods listed above. And who knows, you may even be able to make some extra cash in the process.

When looking for small business loans with

When looking for small business loans with  Even if you have bad credit, there are steps that you can take to improve your credit score. The first step is to make sure that you make all of your payments on time. It would help if you also tried to pay off any outstanding debts. Following these steps will increase your credit score over time and make it easier for you to get various better loans in the future.

Even if you have bad credit, there are steps that you can take to improve your credit score. The first step is to make sure that you make all of your payments on time. It would help if you also tried to pay off any outstanding debts. Following these steps will increase your credit score over time and make it easier for you to get various better loans in the future.

Before you get cash from an online lender, it’s crucial to learn about the company. Is the website secure? Do any agencies regulate them? What are their reputation like on social media sites and consumer review websites? Even if you only spend five minutes doing some online research before applying for your loan, this can quickly reveal whether or not an online lender is reputable.

Before you get cash from an online lender, it’s crucial to learn about the company. Is the website secure? Do any agencies regulate them? What are their reputation like on social media sites and consumer review websites? Even if you only spend five minutes doing some online research before applying for your loan, this can quickly reveal whether or not an online lender is reputable. It would help if you also considered the interest rates of the loans offered by different lenders. You should look for a lender with interest rates that are competitive and fair compared to others in your area or industry, so you do not end up paying more than necessary. Most online lenders will offer you a pre-approval to compare the rates and terms of different loans before making a decision.

It would help if you also considered the interest rates of the loans offered by different lenders. You should look for a lender with interest rates that are competitive and fair compared to others in your area or industry, so you do not end up paying more than necessary. Most online lenders will offer you a pre-approval to compare the rates and terms of different loans before making a decision.

Your employees cost a lot of money. If you’re located in the United States, specific rules dictate how much your employees must be paid for their time and effort. There is also overtime pay to consider, which means if an employee works more than 40 hours one week, they must receive extra compensation on top of what they would typically get paid for 40 regular hours. You can avoid all of these costs if you hire someone to do the job for you.

Your employees cost a lot of money. If you’re located in the United States, specific rules dictate how much your employees must be paid for their time and effort. There is also overtime pay to consider, which means if an employee works more than 40 hours one week, they must receive extra compensation on top of what they would typically get paid for 40 regular hours. You can avoid all of these costs if you hire someone to do the job for you. It’s not just labor that can add up quickly; operating expenses for your company are constantly increasing as well! You might have to pay rent on your office space, utilities like electricity and water bills each month, physical inventory costs if you run a business with some sort of goods/products being sold directly to customers, etc. You can reduce all of these expenses by outsourcing jobs that are not core to your company’s mission or don’t generate revenue for the organization.

It’s not just labor that can add up quickly; operating expenses for your company are constantly increasing as well! You might have to pay rent on your office space, utilities like electricity and water bills each month, physical inventory costs if you run a business with some sort of goods/products being sold directly to customers, etc. You can reduce all of these expenses by outsourcing jobs that are not core to your company’s mission or don’t generate revenue for the organization. Remember that outsourcing is not just about cutting costs! In many cases, businesses can actually save money in the long term by hiring a third party to handle certain functions.

Remember that outsourcing is not just about cutting costs! In many cases, businesses can actually save money in the long term by hiring a third party to handle certain functions.

If you have a job, then it’s likely that the minimum requirement to get approved for a payday loan is also around your monthly salary. You can usually receive cash within 24 hours or less of applying and being approved – so if you need emergency cash fast, this is an option worth considering. Many people even report getting the money in their account within an hour or two of applying and being accepted.

If you have a job, then it’s likely that the minimum requirement to get approved for a payday loan is also around your monthly salary. You can usually receive cash within 24 hours or less of applying and being approved – so if you need emergency cash fast, this is an option worth considering. Many people even report getting the money in their account within an hour or two of applying and being accepted. If you don’t pay back your payday loan on time, then the company will likely try to collect it from you any way they can. They might even contact other people in your life – like family members or friends who know where you live and work. This could make things very uncomfortable for many people, so keep this in mind if you’re thinking about taking out a payday loan.

If you don’t pay back your payday loan on time, then the company will likely try to collect it from you any way they can. They might even contact other people in your life – like family members or friends who know where you live and work. This could make things very uncomfortable for many people, so keep this in mind if you’re thinking about taking out a payday loan.

Although this seems to be simple, most people struggle with this particular issue. Ensure you understand your worth in the job market. This means you carry out an analysis of your productivity, tasks, and skills. You should note that being underpaid can have a huge effect on your working life. It does not matter how little you are paid; it will have a cumulative effect in the long term. You should always spend less than you earn. That is the only way to ensure you have adequate savings.

Although this seems to be simple, most people struggle with this particular issue. Ensure you understand your worth in the job market. This means you carry out an analysis of your productivity, tasks, and skills. You should note that being underpaid can have a huge effect on your working life. It does not matter how little you are paid; it will have a cumulative effect in the long term. You should always spend less than you earn. That is the only way to ensure you have adequate savings. If you want to run a profitable business, you should start by eliminating stressful situations. In this way, you can focus more on tasks you need to complete. Personal debt can have a lot of stress on your life. Home loans and credit cards contribute to personal debt. This can pull your focus away from the business. When you avoid debt as much as you can and if you must borrow money, make sure to pay it back quickly as possible. You should not live beyond your means.

If you want to run a profitable business, you should start by eliminating stressful situations. In this way, you can focus more on tasks you need to complete. Personal debt can have a lot of stress on your life. Home loans and credit cards contribute to personal debt. This can pull your focus away from the business. When you avoid debt as much as you can and if you must borrow money, make sure to pay it back quickly as possible. You should not live beyond your means.

s money? Consolidating your debts or paying off your medical bills? You should do your homework before contacting a money lender. First, you should identify your needs before contacting a money lender. There is no need to borrow a large amount of money that you need. When choosing a moneylender, you should shop around and consider the repayment terms, fees, and interest charged on loans. In addition to this, you should ensure that the money borrowed is prudently used. In general, you should borrow money from lenders with flexible terms.

s money? Consolidating your debts or paying off your medical bills? You should do your homework before contacting a money lender. First, you should identify your needs before contacting a money lender. There is no need to borrow a large amount of money that you need. When choosing a moneylender, you should shop around and consider the repayment terms, fees, and interest charged on loans. In addition to this, you should ensure that the money borrowed is prudently used. In general, you should borrow money from lenders with flexible terms. people are tempted to hide other loans that they have applied online or from other branches. Existing debts can affect the borrower’s debt-to-income ratio. Lenders will not lend you money when they discover that you are not honest. Remember that your loans are revealed by your credit report.

people are tempted to hide other loans that they have applied online or from other branches. Existing debts can affect the borrower’s debt-to-income ratio. Lenders will not lend you money when they discover that you are not honest. Remember that your loans are revealed by your credit report.

capital investor. This may be according to their experience and previous performances. Get to know their history. What role has a particular venture capitalist played in uplifting startups? Considering this will help you settle for one who will scale your business to a different level.

capital investor. This may be according to their experience and previous performances. Get to know their history. What role has a particular venture capitalist played in uplifting startups? Considering this will help you settle for one who will scale your business to a different level.

Please bear in mind that a credit card may approve your requested transaction even if it already exceeds your credit limit. The bill is going to surprise you by the end of the month. And unfortunately, credit cards that offer decent facilities or privilege usually charge a lot if your use surpasses the limit. Pay attention to their offers so you may get a picture how credit cards in general are.

Please bear in mind that a credit card may approve your requested transaction even if it already exceeds your credit limit. The bill is going to surprise you by the end of the month. And unfortunately, credit cards that offer decent facilities or privilege usually charge a lot if your use surpasses the limit. Pay attention to their offers so you may get a picture how credit cards in general are. Like previously stated, most credit cards offer insurance. Pick the one of which the coverage is the most relevant to your need. If you travel a lot, a credit card with health insurance can be useful for you. Some cards also cover their cardholder’s travel risk.

Like previously stated, most credit cards offer insurance. Pick the one of which the coverage is the most relevant to your need. If you travel a lot, a credit card with health insurance can be useful for you. Some cards also cover their cardholder’s travel risk.

The investor relation consultancy will be like the pillar on which the investors will be communicated through if they have relevant issues. It has helped so much when it comes to the communicating to the investors, and they have improved the process too.

The investor relation consultancy will be like the pillar on which the investors will be communicated through if they have relevant issues. It has helped so much when it comes to the communicating to the investors, and they have improved the process too.

An insurance advisor should be rightfully skilled for the task ahead. The experience of the job is very necessary as it will dictate your benefit of the cover in case of an accident and you need to claim. Education is a key indicator of experience. To verify their technical skills, you need to see the designations on their cards. The appointments will show the level of experience and competence.

An insurance advisor should be rightfully skilled for the task ahead. The experience of the job is very necessary as it will dictate your benefit of the cover in case of an accident and you need to claim. Education is a key indicator of experience. To verify their technical skills, you need to see the designations on their cards. The appointments will show the level of experience and competence. You should review the recommendations about the cover once you get your business quotes. Some clauses may be equivocally written, or the meaning has been hidden and may not mean what you think. Some proposals have exclusions that are important and may be the main reason why you are getting the policy. Therefore, the agent should be able to explain to you the clauses in the contract in detail.…

You should review the recommendations about the cover once you get your business quotes. Some clauses may be equivocally written, or the meaning has been hidden and may not mean what you think. Some proposals have exclusions that are important and may be the main reason why you are getting the policy. Therefore, the agent should be able to explain to you the clauses in the contract in detail.…

Before you choose your merchant service provider, it is essential to make sure that you know who provides merchant services. However, merchant services are offered by specialized companies that are being referred to merchant account providers. Some various organizations are offering this type of service. That is why it is essential to know who provides these merchant services first.

Before you choose your merchant service provider, it is essential to make sure that you know who provides merchant services. However, merchant services are offered by specialized companies that are being referred to merchant account providers. Some various organizations are offering this type of service. That is why it is essential to know who provides these merchant services first.

s to consider which company you are borrowing the loan from. Some of the companies offer high-interest rates that may be you cannot be able to meet their standards based on your financial capability. Therefore, it is essential that you borrow your short-term loan from the company that is reputable.

s to consider which company you are borrowing the loan from. Some of the companies offer high-interest rates that may be you cannot be able to meet their standards based on your financial capability. Therefore, it is essential that you borrow your short-term loan from the company that is reputable. unterproductive to consider taking your pension funds before they reach the retirement age. In any case, there are many reasons to go this route. For instance, you may have built adequate wealth before you get to the age of 60. Others are forced to stop start working early as a result of medical conditions. Studies show that a lot of people are leaving the work life in their early 50s.

unterproductive to consider taking your pension funds before they reach the retirement age. In any case, there are many reasons to go this route. For instance, you may have built adequate wealth before you get to the age of 60. Others are forced to stop start working early as a result of medical conditions. Studies show that a lot of people are leaving the work life in their early 50s.

The bureau should be able to provide in-depth reports of all the payment that you make and all the failed payment. They should always keep you updated on what is going on with your payments. Look for a bureau that will always send your reports via email. The email should contain coded messages detailing the information about each payment and if it failed or successful.

The bureau should be able to provide in-depth reports of all the payment that you make and all the failed payment. They should always keep you updated on what is going on with your payments. Look for a bureau that will always send your reports via email. The email should contain coded messages detailing the information about each payment and if it failed or successful. Different Bureaus have different limits, like the limit amount a customer can pay a month. The restriction should also not be so many because it will limit you from getting the best when it comes to the direct debit.…

Different Bureaus have different limits, like the limit amount a customer can pay a month. The restriction should also not be so many because it will limit you from getting the best when it comes to the direct debit.… This might seem simple, but if you do not remember discussing PPI, there is a real chance that you are a victim of mis-sold PPI. As such, if you do not recall your lender, bank, or broker mentioning something about it at the point of sale, there is a high chance this policy was sneaked to your loan without your consent.

This might seem simple, but if you do not remember discussing PPI, there is a real chance that you are a victim of mis-sold PPI. As such, if you do not recall your lender, bank, or broker mentioning something about it at the point of sale, there is a high chance this policy was sneaked to your loan without your consent. If you are already covered in an another type of pre-insurance policy, chances are that you already have an active PPI. As such, having a PPI Policy on a loan or some credit agreement is not only unnecessary but illegal. If you are convinced that this has happened to you in the past, you are a victim of mis-sold PPI and you are entitled to compensation.

If you are already covered in an another type of pre-insurance policy, chances are that you already have an active PPI. As such, having a PPI Policy on a loan or some credit agreement is not only unnecessary but illegal. If you are convinced that this has happened to you in the past, you are a victim of mis-sold PPI and you are entitled to compensation.

Unlike taking a loan, where you have to go through many procedures before you get your loan approved, this is not the case with a cash advance. There are no many processes involved in taking a cash advance. Also, cash advances are processed quickly. If you have a high credit score, you may consider taking a cash advance as opposed to taking a loan. The reason is simple, a high credit score, limits the loan amount granted and lengthens the loan borrowing procedure.

Unlike taking a loan, where you have to go through many procedures before you get your loan approved, this is not the case with a cash advance. There are no many processes involved in taking a cash advance. Also, cash advances are processed quickly. If you have a high credit score, you may consider taking a cash advance as opposed to taking a loan. The reason is simple, a high credit score, limits the loan amount granted and lengthens the loan borrowing procedure.

To boost your business, you should spend your precious time, doing the things you excel at. Tax accounting is probably not one of these. In case you do have some knowledge and experience, in regards to tax and accounting tasks, you will probably manage to handle most of them somehow. But the main question is, will you handle them correctly, and in time? Missing the deadlines for delivering important documents, including taxes, usually, results in severe fines and penalties. In the best possible scenario, an incorrectly completed document will be sent back, to be corrected and finished accordingly. In the worst case scenario, a tax inspector will show up at the doors of your office, with the incorrect document in his hands, wanting to painstakingly examine every single business paper and document you have. A tax accountant can help you avoid all of these issues, with his/her expertise and experience.

To boost your business, you should spend your precious time, doing the things you excel at. Tax accounting is probably not one of these. In case you do have some knowledge and experience, in regards to tax and accounting tasks, you will probably manage to handle most of them somehow. But the main question is, will you handle them correctly, and in time? Missing the deadlines for delivering important documents, including taxes, usually, results in severe fines and penalties. In the best possible scenario, an incorrectly completed document will be sent back, to be corrected and finished accordingly. In the worst case scenario, a tax inspector will show up at the doors of your office, with the incorrect document in his hands, wanting to painstakingly examine every single business paper and document you have. A tax accountant can help you avoid all of these issues, with his/her expertise and experience. Aside from preparing and minimizing your taxes, a tax accountant can be instrumental in providing sound advice, on how to grow your business. This is extremely important if your business is still in its infancy. Making correct managerial and financial decisions from the start will propel the business in the right direction. Making poor ones will ruin it. Always keep in mind, that an expert accountant is most likely much more versed in the financial side of any business than you …

Aside from preparing and minimizing your taxes, a tax accountant can be instrumental in providing sound advice, on how to grow your business. This is extremely important if your business is still in its infancy. Making correct managerial and financial decisions from the start will propel the business in the right direction. Making poor ones will ruin it. Always keep in mind, that an expert accountant is most likely much more versed in the financial side of any business than you …

al equity. They form their own distinct cycles. Due to the inherent risk assessment and caution, they have little correlation. Hedge funds have a low volatility of portfolio during the period in which the traditional investments like stocks are performing poorly in the financial market. In the past, alternative investments have been limited to high-net-worth investors, but in recent times there has been a shift to accommodate more investors in the market. There are many investment products accessible today, and at times it is hard to properly identify which is one is a conventional investment and one that is alternative. The following is a list of common alternative investments.

al equity. They form their own distinct cycles. Due to the inherent risk assessment and caution, they have little correlation. Hedge funds have a low volatility of portfolio during the period in which the traditional investments like stocks are performing poorly in the financial market. In the past, alternative investments have been limited to high-net-worth investors, but in recent times there has been a shift to accommodate more investors in the market. There are many investment products accessible today, and at times it is hard to properly identify which is one is a conventional investment and one that is alternative. The following is a list of common alternative investments. s are accessible to assets categories like real estate and commodities. Mutual funds can easily be sold in a public market. Therefore, they are available to a wider market of investors and in this regard mutual funds are restricted by law from using high leveraging to enhance returns as is the case in hedge funds.

s are accessible to assets categories like real estate and commodities. Mutual funds can easily be sold in a public market. Therefore, they are available to a wider market of investors and in this regard mutual funds are restricted by law from using high leveraging to enhance returns as is the case in hedge funds.

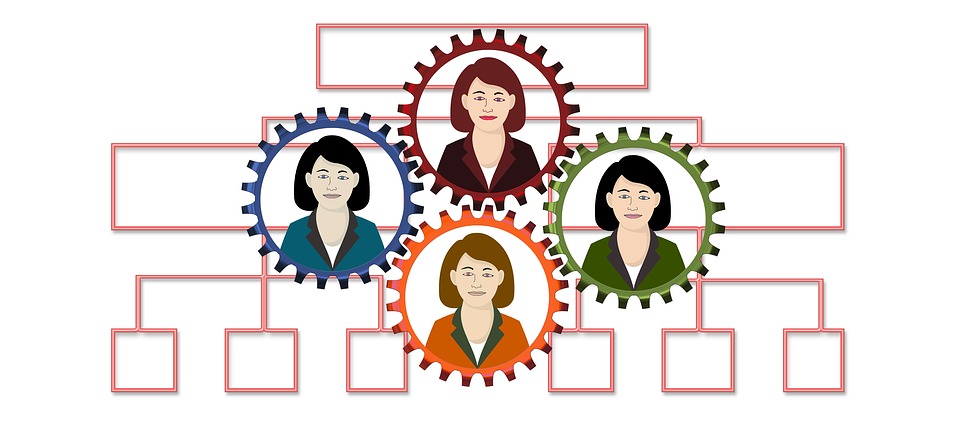

For the changes in the enterprise to be fully implemented, an individual who is a manager should be a good leader. The change must be organized and planned by the director, and his or her leadership skills should be put in practice so as he or she can inspire employees to embrace the changes. Leadership is an impalpable and complex skill that involves an individual passing information to a particular group of individuals and at the same time encouraging them to embrace a position.

For the changes in the enterprise to be fully implemented, an individual who is a manager should be a good leader. The change must be organized and planned by the director, and his or her leadership skills should be put in practice so as he or she can inspire employees to embrace the changes. Leadership is an impalpable and complex skill that involves an individual passing information to a particular group of individuals and at the same time encouraging them to embrace a position. When the right information is passed to the employees relating to the vision of the firm, the preset goals and objectives are likely to be attained under the specified duration of time. Communication is a vital factor of managing change easily with minimum problems experienced. Direct reports in the company must be run by managers so that operations in the business to run smoothly and delays will be avoided.…

When the right information is passed to the employees relating to the vision of the firm, the preset goals and objectives are likely to be attained under the specified duration of time. Communication is a vital factor of managing change easily with minimum problems experienced. Direct reports in the company must be run by managers so that operations in the business to run smoothly and delays will be avoided.…

A small business that cannot afford to purchase equipment can opt to lease equipment as a financing option. However, it is not the ideal financing option for a small business, but it offers a good way for a small business to get started. After all, there is an option of purchasing the equipment at the end of the lease. At the expiry of the lease, the business should be in a position to purchase the equipment.

A small business that cannot afford to purchase equipment can opt to lease equipment as a financing option. However, it is not the ideal financing option for a small business, but it offers a good way for a small business to get started. After all, there is an option of purchasing the equipment at the end of the lease. At the expiry of the lease, the business should be in a position to purchase the equipment.

One of the most important financial tips is to use cash instead of credit. Many financial advisors suggest the use of cash instead of credit card due to the tendency to spend more when using credit cards. A person will tend to spend more when using a credit card than when using cash. Therefore, let the credit card come only during emergencies.

One of the most important financial tips is to use cash instead of credit. Many financial advisors suggest the use of cash instead of credit card due to the tendency to spend more when using credit cards. A person will tend to spend more when using a credit card than when using cash. Therefore, let the credit card come only during emergencies.