People often assume major artists rake in huge profits every time they hit the road. The reality is far less glamorous. Large-scale tours can drain budgets fast, especially once production costs, staff pay, and travel bills start stacking up. Even legendary performances like the one referenced through alison krauss robert plant black dog remind us that behind great shows sits a massive financial machine that can wobble under pressure.

Rising Production Costs That Outrun Ticket Sales

Modern tours place heavy emphasis on spectacle. Light shows, custom staging, pyrotechnics, and huge screens cost a fortune. While fans enjoy the experience, the bill grows like ivy on an old wall. If ticket sales don’t surge enough, artists feel the financial pinch fast. Transporting all that gear adds another layer of expense. Trucks, crew members, and constant travel burn through funds daily. Even small delays or equipment issues can increase spending. One bad week on the road can tip the balance from profitable to stressful.

Marketing Expenses That Don’t Always Pay Off

Big tours often rely on massive promotional campaigns. Ads, social strategies, and partnerships can cost as much as a small indie film budget. The hope is that hype boosts sales drastically. But sometimes the crowd response doesn’t match the investment. Marketing teams can misjudge audience interest. Trends shift quickly, and a tour built around an older album might not hit projected numbers. Money spent on promotion doesn’t automatically guarantee packed venues. Some artists end up paying more to promote the show than they earn from it.

Unpredictable Attendance and Shifting Fan Behavior

Ticket sales used to be a steadier stream. These days, buying patterns feel more like a roller coaster. Fans hesitate, budgets tighten, and last-minute decisions are common. This unpredictability creates financial pressure for artists planning months ahead. Even big artists face no-shows or half-filled venues. External events, economic dips, or even bad weather can dent turnout. Tours rely heavily on consistent attendance to stay profitable. When crowds don’t show up, the financial hit lands quickly.

Travel Complications That Drain Budgets

Moving a tour across different cities is never simple. Fuel prices change, travel restrictions shift, and lodging costs vary wildly. Each stop presents a new set of expenses. Even minor adjustments can throw off the budget. International tours bring added layers of cost. Visas, shipping fees, and currency differences stretch finances further. One unexpected cancellation can ripple through the entire schedule. The pressure to keep everything on track becomes intense.

Insurance, Staff, and Other Hidden Costs

Insurance is a major part of touring, especially for high-profile acts. Policies for equipment, cancellations, and liability come with steep premiums. These costs often surprise fans who assume revenue solves everything. Then comes staff pay. Crews include sound techs, lighting pros, drivers, coordinators, and many others. Each paycheck adds up quickly. Even food and lodging for the team can cost thousands over a long tour. What seems like a glamorous operation is, in truth, a giant financial puzzle that doesn’t always fit neatly.

Some tours earn huge profits, while others barely break even. The money behind the scenes is far more fragile than most people think. For big artists, touring is a mix of passion, risk, and a long list of expenses that demand constant attention. Understanding these financial pressures paints a clearer picture of why some tours become difficult investments despite their star power.…

Smart financial …

Smart financial …

Without a clear plan, how can you expect to reach your desired financial goals? Having no financial plan is like driving blindfolded – it’s risky and likely to lead you off course. A solid financial plan is the GPS of your money journey. It helps you navigate through life’s twists and turns, ensuring that you stay on track towards your objectives. By setting specific goals, creating a budget, and outlining actionable steps, you can take control of your finances and steer them in the right direction. Without a roadmap for your money, it’s easy to fall into bad spending habits or miss out on opportunities for growth.

Without a clear plan, how can you expect to reach your desired financial goals? Having no financial plan is like driving blindfolded – it’s risky and likely to lead you off course. A solid financial plan is the GPS of your money journey. It helps you navigate through life’s twists and turns, ensuring that you stay on track towards your objectives. By setting specific goals, creating a budget, and outlining actionable steps, you can take control of your finances and steer them in the right direction. Without a roadmap for your money, it’s easy to fall into bad spending habits or miss out on opportunities for growth. Lastly, neglecting investments can be a major

Lastly, neglecting investments can be a major

Climate change poses a wide range of risks, from extreme weather events to rising sea levels and changes in disease patterns. These risks can have severe consequences for individuals, businesses, and entire communities. For the insurance industry, these risks translate into increased payouts as losses due to natural disasters and other climate-related events continue to rise. This has put immense pressure on insurers to reassess their risk assessments and find ways to adapt to the changing climate.

Climate change poses a wide range of risks, from extreme weather events to rising sea levels and changes in disease patterns. These risks can have severe consequences for individuals, businesses, and entire communities. For the insurance industry, these risks translate into increased payouts as losses due to natural disasters and other climate-related events continue to rise. This has put immense pressure on insurers to reassess their risk assessments and find ways to adapt to the changing climate. Climate change poses unprecedented challenges to the insurance industry, but it also presents an opportunity for innovative

Climate change poses unprecedented challenges to the insurance industry, but it also presents an opportunity for innovative

Home damage often comes with unexpected expenses. Creating a detailed budget that encompasses both immediate and long-term needs is crucial. Identify areas where you can cut back on discretionary spending while prioritizing essential expenses. Communicate with utility providers and creditors to discuss possible payment extensions or alternative arrangements to ease financial strain.

Home damage often comes with unexpected expenses. Creating a detailed budget that encompasses both immediate and long-term needs is crucial. Identify areas where you can cut back on discretionary spending while prioritizing essential expenses. Communicate with utility providers and creditors to discuss possible payment extensions or alternative arrangements to ease financial strain.

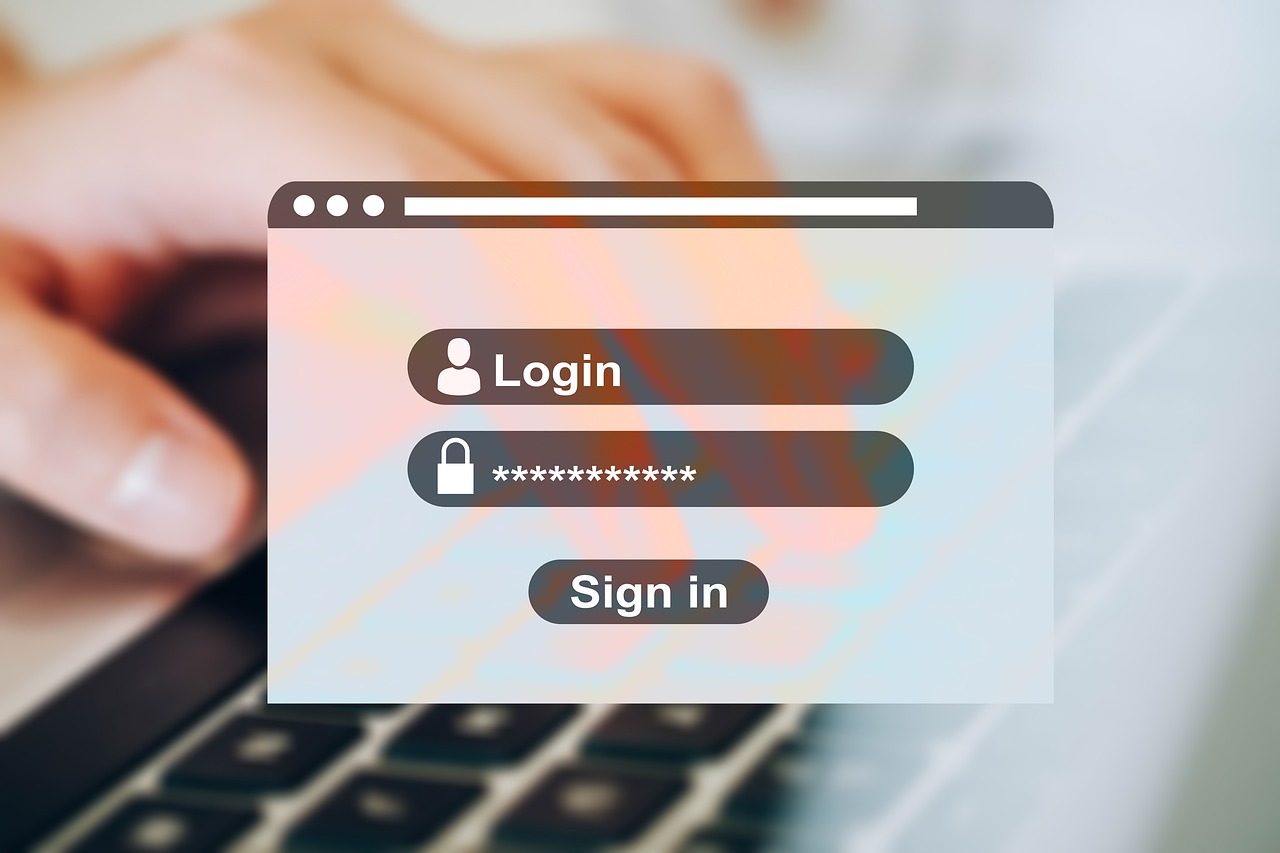

Before you get cash from an online lender, it’s crucial to learn about the company. Is the website secure? Do any agencies regulate them? What are their reputation like on social media sites and consumer review websites? Even if you only spend five minutes doing some online research before applying for your loan, this can quickly reveal whether or not an online lender is reputable.

Before you get cash from an online lender, it’s crucial to learn about the company. Is the website secure? Do any agencies regulate them? What are their reputation like on social media sites and consumer review websites? Even if you only spend five minutes doing some online research before applying for your loan, this can quickly reveal whether or not an online lender is reputable. It would help if you also considered the interest rates of the loans offered by different lenders. You should look for a lender with interest rates that are competitive and fair compared to others in your area or industry, so you do not end up paying more than necessary. Most online lenders will offer you a pre-approval to compare the rates and terms of different loans before making a decision.

It would help if you also considered the interest rates of the loans offered by different lenders. You should look for a lender with interest rates that are competitive and fair compared to others in your area or industry, so you do not end up paying more than necessary. Most online lenders will offer you a pre-approval to compare the rates and terms of different loans before making a decision.

Your employees cost a lot of money. If you’re located in the United States, specific rules dictate how much your employees must be paid for their time and effort. There is also overtime pay to consider, which means if an employee works more than 40 hours one week, they must receive extra compensation on top of what they would typically get paid for 40 regular hours. You can avoid all of these costs if you hire someone to do the job for you.

Your employees cost a lot of money. If you’re located in the United States, specific rules dictate how much your employees must be paid for their time and effort. There is also overtime pay to consider, which means if an employee works more than 40 hours one week, they must receive extra compensation on top of what they would typically get paid for 40 regular hours. You can avoid all of these costs if you hire someone to do the job for you. It’s not just labor that can add up quickly; operating expenses for your company are constantly increasing as well! You might have to pay rent on your office space, utilities like electricity and water bills each month, physical inventory costs if you run a business with some sort of goods/products being sold directly to customers, etc. You can reduce all of these expenses by outsourcing jobs that are not core to your company’s mission or don’t generate revenue for the organization.

It’s not just labor that can add up quickly; operating expenses for your company are constantly increasing as well! You might have to pay rent on your office space, utilities like electricity and water bills each month, physical inventory costs if you run a business with some sort of goods/products being sold directly to customers, etc. You can reduce all of these expenses by outsourcing jobs that are not core to your company’s mission or don’t generate revenue for the organization. Remember that outsourcing is not just about cutting costs! In many cases, businesses can actually save money in the long term by hiring a third party to handle certain functions.

Remember that outsourcing is not just about cutting costs! In many cases, businesses can actually save money in the long term by hiring a third party to handle certain functions.

If you have a job, then it’s likely that the minimum requirement to get approved for a payday loan is also around your monthly salary. You can usually receive cash within 24 hours or less of applying and being approved – so if you need emergency cash fast, this is an option worth considering. Many people even report getting the money in their account within an hour or two of applying and being accepted.

If you have a job, then it’s likely that the minimum requirement to get approved for a payday loan is also around your monthly salary. You can usually receive cash within 24 hours or less of applying and being approved – so if you need emergency cash fast, this is an option worth considering. Many people even report getting the money in their account within an hour or two of applying and being accepted. If you don’t pay back your payday loan on time, then the company will likely try to collect it from you any way they can. They might even contact other people in your life – like family members or friends who know where you live and work. This could make things very uncomfortable for many people, so keep this in mind if you’re thinking about taking out a payday loan.

If you don’t pay back your payday loan on time, then the company will likely try to collect it from you any way they can. They might even contact other people in your life – like family members or friends who know where you live and work. This could make things very uncomfortable for many people, so keep this in mind if you’re thinking about taking out a payday loan.

Although this seems to be simple, most people struggle with this particular issue. Ensure you understand your worth in the job market. This means you carry out an analysis of your productivity, tasks, and skills. You should note that being underpaid can have a huge effect on your working life. It does not matter how little you are paid; it will have a cumulative effect in the long term. You should always spend less than you earn. That is the only way to ensure you have adequate savings.

Although this seems to be simple, most people struggle with this particular issue. Ensure you understand your worth in the job market. This means you carry out an analysis of your productivity, tasks, and skills. You should note that being underpaid can have a huge effect on your working life. It does not matter how little you are paid; it will have a cumulative effect in the long term. You should always spend less than you earn. That is the only way to ensure you have adequate savings. If you want to run a profitable business, you should start by eliminating stressful situations. In this way, you can focus more on tasks you need to complete. Personal debt can have a lot of stress on your life. Home loans and credit cards contribute to personal debt. This can pull your focus away from the business. When you avoid debt as much as you can and if you must borrow money, make sure to pay it back quickly as possible. You should not live beyond your means.

If you want to run a profitable business, you should start by eliminating stressful situations. In this way, you can focus more on tasks you need to complete. Personal debt can have a lot of stress on your life. Home loans and credit cards contribute to personal debt. This can pull your focus away from the business. When you avoid debt as much as you can and if you must borrow money, make sure to pay it back quickly as possible. You should not live beyond your means.

s money? Consolidating your debts or paying off your medical bills? You should do your homework before contacting a money lender. First, you should identify your needs before contacting a money lender. There is no need to borrow a large amount of money that you need. When choosing a moneylender, you should shop around and consider the repayment terms, fees, and interest charged on loans. In addition to this, you should ensure that the money borrowed is prudently used. In general, you should borrow money from lenders with flexible terms.

s money? Consolidating your debts or paying off your medical bills? You should do your homework before contacting a money lender. First, you should identify your needs before contacting a money lender. There is no need to borrow a large amount of money that you need. When choosing a moneylender, you should shop around and consider the repayment terms, fees, and interest charged on loans. In addition to this, you should ensure that the money borrowed is prudently used. In general, you should borrow money from lenders with flexible terms. people are tempted to hide other loans that they have applied online or from other branches. Existing debts can affect the borrower’s debt-to-income ratio. Lenders will not lend you money when they discover that you are not honest. Remember that your loans are revealed by your credit report.

people are tempted to hide other loans that they have applied online or from other branches. Existing debts can affect the borrower’s debt-to-income ratio. Lenders will not lend you money when they discover that you are not honest. Remember that your loans are revealed by your credit report.

capital investor. This may be according to their experience and previous performances. Get to know their history. What role has a particular venture capitalist played in uplifting startups? Considering this will help you settle for one who will scale your business to a different level.

capital investor. This may be according to their experience and previous performances. Get to know their history. What role has a particular venture capitalist played in uplifting startups? Considering this will help you settle for one who will scale your business to a different level.

Before you choose your merchant service provider, it is essential to make sure that you know who provides merchant services. However, merchant services are offered by specialized companies that are being referred to merchant account providers. Some various organizations are offering this type of service. That is why it is essential to know who provides these merchant services first.

Before you choose your merchant service provider, it is essential to make sure that you know who provides merchant services. However, merchant services are offered by specialized companies that are being referred to merchant account providers. Some various organizations are offering this type of service. That is why it is essential to know who provides these merchant services first.

s to consider which company you are borrowing the loan from. Some of the companies offer high-interest rates that may be you cannot be able to meet their standards based on your financial capability. Therefore, it is essential that you borrow your short-term loan from the company that is reputable.

s to consider which company you are borrowing the loan from. Some of the companies offer high-interest rates that may be you cannot be able to meet their standards based on your financial capability. Therefore, it is essential that you borrow your short-term loan from the company that is reputable. unterproductive to consider taking your pension funds before they reach the retirement age. In any case, there are many reasons to go this route. For instance, you may have built adequate wealth before you get to the age of 60. Others are forced to stop start working early as a result of medical conditions. Studies show that a lot of people are leaving the work life in their early 50s.

unterproductive to consider taking your pension funds before they reach the retirement age. In any case, there are many reasons to go this route. For instance, you may have built adequate wealth before you get to the age of 60. Others are forced to stop start working early as a result of medical conditions. Studies show that a lot of people are leaving the work life in their early 50s.

The bureau should be able to provide in-depth reports of all the payment that you make and all the failed payment. They should always keep you updated on what is going on with your payments. Look for a bureau that will always send your reports via email. The email should contain coded messages detailing the information about each payment and if it failed or successful.

The bureau should be able to provide in-depth reports of all the payment that you make and all the failed payment. They should always keep you updated on what is going on with your payments. Look for a bureau that will always send your reports via email. The email should contain coded messages detailing the information about each payment and if it failed or successful. Different Bureaus have different limits, like the limit amount a customer can pay a month. The restriction should also not be so many because it will limit you from getting the best when it comes to the direct debit.…

Different Bureaus have different limits, like the limit amount a customer can pay a month. The restriction should also not be so many because it will limit you from getting the best when it comes to the direct debit.… This might seem simple, but if you do not remember discussing PPI, there is a real chance that you are a victim of mis-sold PPI. As such, if you do not recall your lender, bank, or broker mentioning something about it at the point of sale, there is a high chance this policy was sneaked to your loan without your consent.

This might seem simple, but if you do not remember discussing PPI, there is a real chance that you are a victim of mis-sold PPI. As such, if you do not recall your lender, bank, or broker mentioning something about it at the point of sale, there is a high chance this policy was sneaked to your loan without your consent. If you are already covered in an another type of pre-insurance policy, chances are that you already have an active PPI. As such, having a PPI Policy on a loan or some credit agreement is not only unnecessary but illegal. If you are convinced that this has happened to you in the past, you are a victim of mis-sold PPI and you are entitled to compensation.

If you are already covered in an another type of pre-insurance policy, chances are that you already have an active PPI. As such, having a PPI Policy on a loan or some credit agreement is not only unnecessary but illegal. If you are convinced that this has happened to you in the past, you are a victim of mis-sold PPI and you are entitled to compensation.

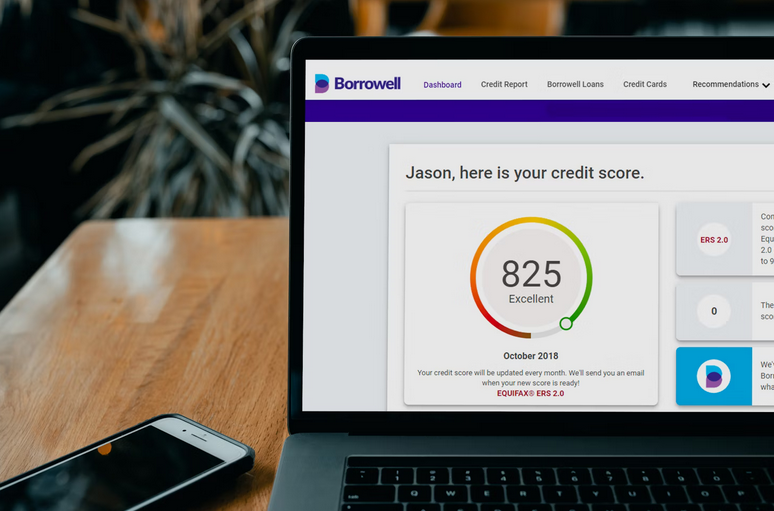

Unlike taking a loan, where you have to go through many procedures before you get your loan approved, this is not the case with a cash advance. There are no many processes involved in taking a cash advance. Also, cash advances are processed quickly. If you have a high credit score, you may consider taking a cash advance as opposed to taking a loan. The reason is simple, a high credit score, limits the loan amount granted and lengthens the loan borrowing procedure.

Unlike taking a loan, where you have to go through many procedures before you get your loan approved, this is not the case with a cash advance. There are no many processes involved in taking a cash advance. Also, cash advances are processed quickly. If you have a high credit score, you may consider taking a cash advance as opposed to taking a loan. The reason is simple, a high credit score, limits the loan amount granted and lengthens the loan borrowing procedure.